The headline figures are startling: month-on-month the price of a median Aussie home is rising at its fastest rate in 32 years.

There are now entire generations – this author included – who in their lifetimes have never seen the chance of purchasing the Aussie dream slip away as rapidly.

But what's contributing to the electric market where crowds of potential bidders are willing to stand in a once-in-100-year rainstorm to bid for a Sydney semi?

READ MORE: Sydney real estate agents facing crackdown on underquoting

According to CoreLogic's Hedonic Home Value Index, nationally the median value of an Australian dwelling rose 2.8 per cent in March to $614,768.

That price includes both detached homes and units.

Buried in the data however, is potentially the reason why. The strength of the housing market, according to CoreLogic, is being "supported by a disconnect between demand and supply".

READ MORE: New generation of homeowners buying thanks to the bank of mum and dad

Tim Lawless, CoreLogic's research director, said buyer demand is so intense currently that it is outweighing the ability of sellers to put their property on the market.

"The ratio of sales to new listings is tracking at around 1.1, implying for every new listing added to the market, 1.1 homes are sold," Mr Lawless said.

"Such a rapid rate of absorption is keeping overall inventory levels low and adding to a sense of FOMO amongst buyers."

READ MORE: Boom time for Australia's residential property market

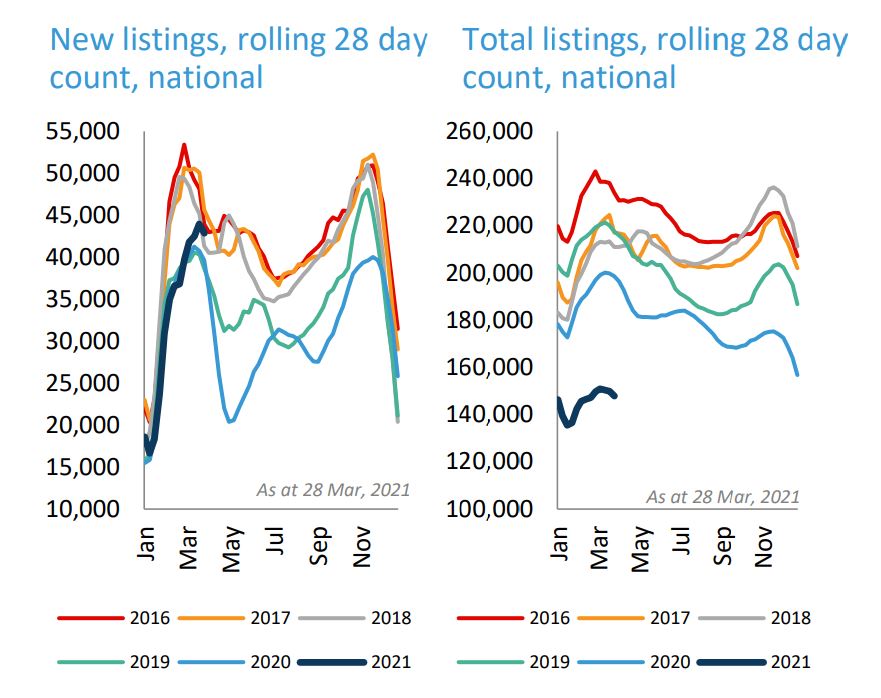

According to Corelogic, the national total listing numbers over the four weeks to the end of March show stock levels were 25.5 per cent below the five-year average.

Combine that with an auction clearance rate of consistently above 80 per cent, and you have a recipe for homes being pushed above reserve due to buyer demand, and a greater sense that if buyers don't "get in" now, they never will.

That sense of FOMO – or the fear of missing out – realises itself in packed auctions as more and more potential buyers throw their hat into the ring due to historic low interest rates and the availability of finance.

Quite simply, money is cheap.

READ MORE: Three-bedroom Sydney home sells for $9 million

And we seem to be borrowing more of it too. New data from the Australian Bureau of Statistics (ABS) released today shows that the total value of new loan commitments for owner-occupier housing – that is people buying places where they actually want to live – was a staggering $21.7 billion in one month.

That's 55.2 per cent higher than it was in February 2020, prior to the COVID pandemic.

In February 2003, people were only borrowing $7 billion for their owner-occupier housing.

READ MORE: Sydney property prices hit all-time high

The question now remains, how long will this growth continue?

Going back to Corelogic, it appears that a slowing of growth is inevitable.

"While we are expecting housing values to continue rising throughout 2021 and well into next year, it is reasonable to expect the pace of growth will slow," researchers write.

"Earlier periods of similar exuberance have been previously quelled by factors such as rising interest rates, weaker economic conditions or changes to credit availability."

READ MORE: Huge number of Aussie homeowners considering sale

Speculation over what will trigger a fall in the property market now rests on three key indicators: whether interest rates will rise, whether government supports for first homebuyers will continue, and the prospect of restrictions on banks on how much money they are allowed to lend.

"Overall, housing markets are continuing to respond to a broad range of positive factors including record-low interest rates and recent economic conditions that have consistently beaten forecasts," summarise the analysts.

"In response, Australians are feeling optimistic and confident in making high commitment decisions related to the property market.

"The upswing in buyer demand has not been met with the same level of increase in inventory. This has resulted in strong selling conditions, amidst a palpable sense of urgency amongst buyers, putting upwards pressure on housing prices."

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.