Thousands of Australian families are being hit with bills from the Federal Government demanding they repay childcare subsidies – and their deadline is only weeks away.

Centrelink has sent letters across the country detailing debts dating back to the 2017-2018 tax year.

Many have been told to pay up later this month.

READ MORE: How to claim the COVID-19 Disaster Payment

The childcare subsidy is paid based on an estimate of your income but if your actual income is more, the government asks to be repaid.

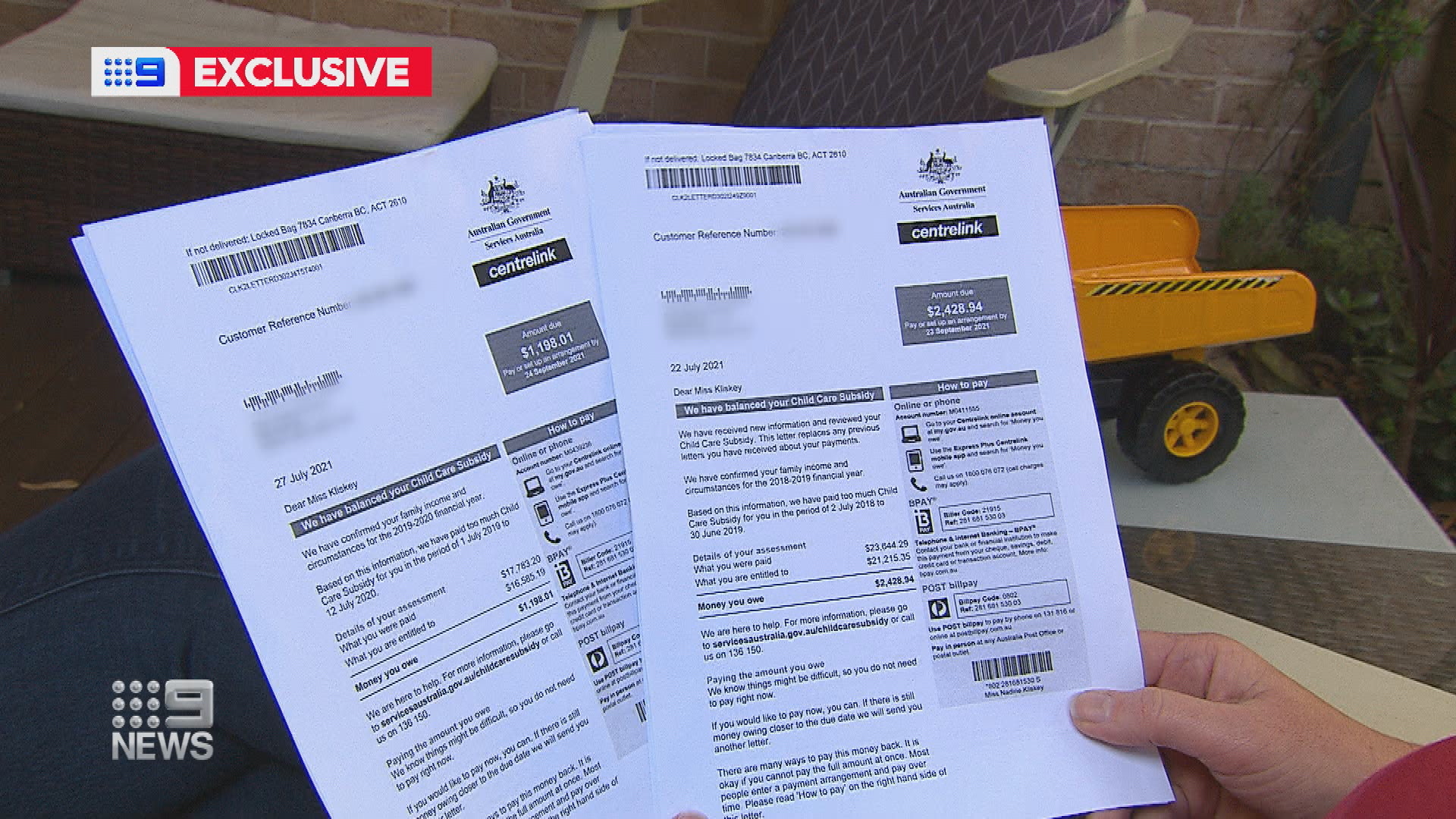

Nadine Kliskey from Mona Vale on Sydney's Northern Beaches started claiming the COVID-19 Disaster Payments after losing most of her income during the pandemic.

The last thing the mother-of-two expected was a bill from the same government department chasing her for $3500 in childcare subsidy payments it claims she was overpaid.

"It's rather ironic that in one hand they are giving me money and in the other hand they are asking me to give money to them," she told 9News.

"I feel the system is flawed.

"Not only do we spend an extortionate amount on childcare, more than any other country, but this system that the government has put in place to supposedly help us and get mums back into the workforce, has got little loopholes where they can throw out random bills to us.

"My question for Centrelink is, I want more information about this, I want to understand it, break it down for me and explain it for me, so I know this information is right."

READ MORE: Court approves $1.7b settlement for 'shameful' Robodebt scheme

Ms Kliskey vented her frustrations on a local mums' Facebook group, only to discover hundreds of other families had been blindsided by huge Centrelink bills, despite many being under significant financial strain due to the lockdown.

Dee Why mum Rachel Christopher runs a music school.

She's lost 30 per cent of her business during lockdown and now she's been told she owes $1600.

"It's a debt that I had built up from the childcare subsidy, that I had no idea I was building up, neither the child care or Centrelink let me know," she said.

"I'm a sole parent who provides all by herself for her child, so we may even need to relocate."

Services Australia wouldn't say how many families it's pursuing.

READ MORE: Job hunters risking being reported to satisfy Federal Government's Jobseeker requirements

"If they've correctly declared their income, obviously there is no effect, if they have over-declared their income, obviously we seek to recover that money," Services Australia General Manager Hank Jongen said.

"The key is, talk to us, because what we don't want to do is add to your overall financial burden and we can enter into flexible payment arrangements, in relation to those debts.

"You can contact us, tell us you want to dispute the debt, that will trigger a review process internally and if you still believe we've made the incorrect decision, there's an independent tribunal you can go to."

H&R Block's Director of Tax Communications Mark Chapman said if you're unsure as to why you have been asked to make a repayment, speak to your accountant.

"Don't just pay it. Do check with your accountant and hopefully they will be able to give a clear explanation as to where Centrelink got their figures from," he said.

Full statement from Services Australia

We know many people are still doing it tough and Services Australia is sensitive to the challenging circumstances people face, including those impacted by the current lockdowns.

People with a Centrelink debt who are experiencing financial hardship can contact Services Australia on 1800 076 072 to arrange flexible repayments suited to their situation.

After the end of the financial year we balance family payments, including Child Care Subsidy, to make sure we've paid families the right amount.

This process occurs when families lodge their tax return or otherwise confirm their income.

Families have two years to confirm their income. This is why some of these overpayments date back a number of years. If they have not done this within two years, a debt may be raised.

When we balance payments there are three possible outcomes — top-up, no change or an overpayment. The overwhelming majority of families have a top-up or no change when their balancing is complete.

Additional information

- People can also manage their Centrelink debts using the money you owe service

- This is available in their Centrelink online account through myGov, or Express Plus Centrelink mobile app

- Specific data around these letters isn't immediately available and would be an unreasonable diversion of resources at this time.

Child Care Subsidy balancing for 2018-19 financial year

Families have two years after each financial year ends to confirm income for that financial year or we will send them an account payable notice.

We have recently reached two years since the 2018-19 financial year ended and have sent letters to families who still haven't confirmed their income.

Even though the deadline has passed, it's not too late for families to take action and for us to reassess their debt.

For more information about balancing family payments, go to www.servicesaustralia.gov.au/balancing

National debt pause and restart of debt activity

Last year, we paused a range of debt raising and recovery activity nationally.

We restarted debt activity late last year because we understand that telling people if they've been overpaid helps give them certainty about their situation and allows them to plan for the future.

People who now have a Centrelink debt and are experiencing financial hardship can be reassured that Services Australia will work with them to come up with a solution that suits their circumstances.