Interest rates are soaring and inflation is showing no sign of slowing down, sparking concerns that Australia is headed for a recession in 2023.

If Australia enters a recession it could lead to mass mortgage defaults, forced sales of homes, joblessness and a further heightening of the rental affordability crisis.

But this is the worst-case scenario and experts claim it isn't all cause for concern as current predictions show the economic landscape is moderating. Here is what is forecast for 2023:

READ MORE: Home buyers warned of 'four more interest rate hikes by August'

What is a recession?

A recession is a prolonged period of weak or negative growth in Gross Domestic Product (GDP), which is the monetary value of all goods and services, is accompanied by a rise in unemployment, according to the Reserve Bank of Australia.

Basically, if GDP goes down and unemployment goes up it can equal a recession.

A "technical recession" - which may not be accompanied by a jump in unemployment - is traditionally defined as two consecutive quarters of negative growth in GDP.

If you take that definition, then the US went into a recession in 2022.

When was Australia's last recession?

Australia suffered a recession from 1990 to 1991 when GDP fell by 1.7 per cent and the unemployment rate rose to 10.8 per cent.

In 1991, interest rates were at an all-time high and so was the inflation percentage.

The impact of the recession was dire for Australians when many lost their jobs, were forced to sell homes and bankruptcies soared.

Surprisingly, Australia was one of the only major economies to come out relatively unscathed during the Global Financial Crisis from 2007 to 2008.

"The Australian economy fared much better than most because it had a sound financial system, a relatively large exposure to the buoyant Chinese economy, and strong macroeconomic stimulus to cushion it from the global downturn," the RBA said.

On a technical basis, Australia's last recession far more recent.

During the peak of the COVID-19 pandemic, the June quarter of 2020 showed a drop in GDP of 7 per cent - the second consecutive quarter to record a drop.

Given the exceptional circumstances leading to the two-quarter drop - and the relative stability of unemployment at the time - some do not regard the events of 2020 as reflective of a traditional recession.

READ MORE: Inflation in Australia rises to higher-than-expected 7.8 per cent

Is 2023 the year of the recession for Australia?

Although Australia has avoided the worst affects of a recession for almost 30 years, 2023 may be the year of a shallow dip into a recession according to financial experts.

With GDP on an upward trajectory, a 0.6 per cent uptick to be precise, and unemployment at an all-time low at 3.5 per cent - we're in a good economic situation.

Finance expert and professor at the University of New South Wales Mark Humphries-Jenner said there are various predictions about a recession but the good news at this point in time is Australia will likely escape - with one exception.

"We can see most people aren't predicting a massively, deep, dire or painful recession," he told 9News.com.au.

"Instead they're predicting a small dip into a recession that will ultimately be corrected."

But even with the relatively positive prediction, uncontrollable inflation and constant interest rate hikes - 2023 could be sticky.

Humphries-Jenner said Australia's abundance of natural commodities helps to support the Australian economy, therefore buffering GDP and the likelihood of a recession.

However if the RBA continues hiking interest rates to historic highs for too long, Humphries-Jenner claims we're in for a recession.

READ MORE: What is inflation? And how a record-high CPI might affect you

READ MORE: Cost of living crisis set to deepen, as Treasurer agrees inflation will rise

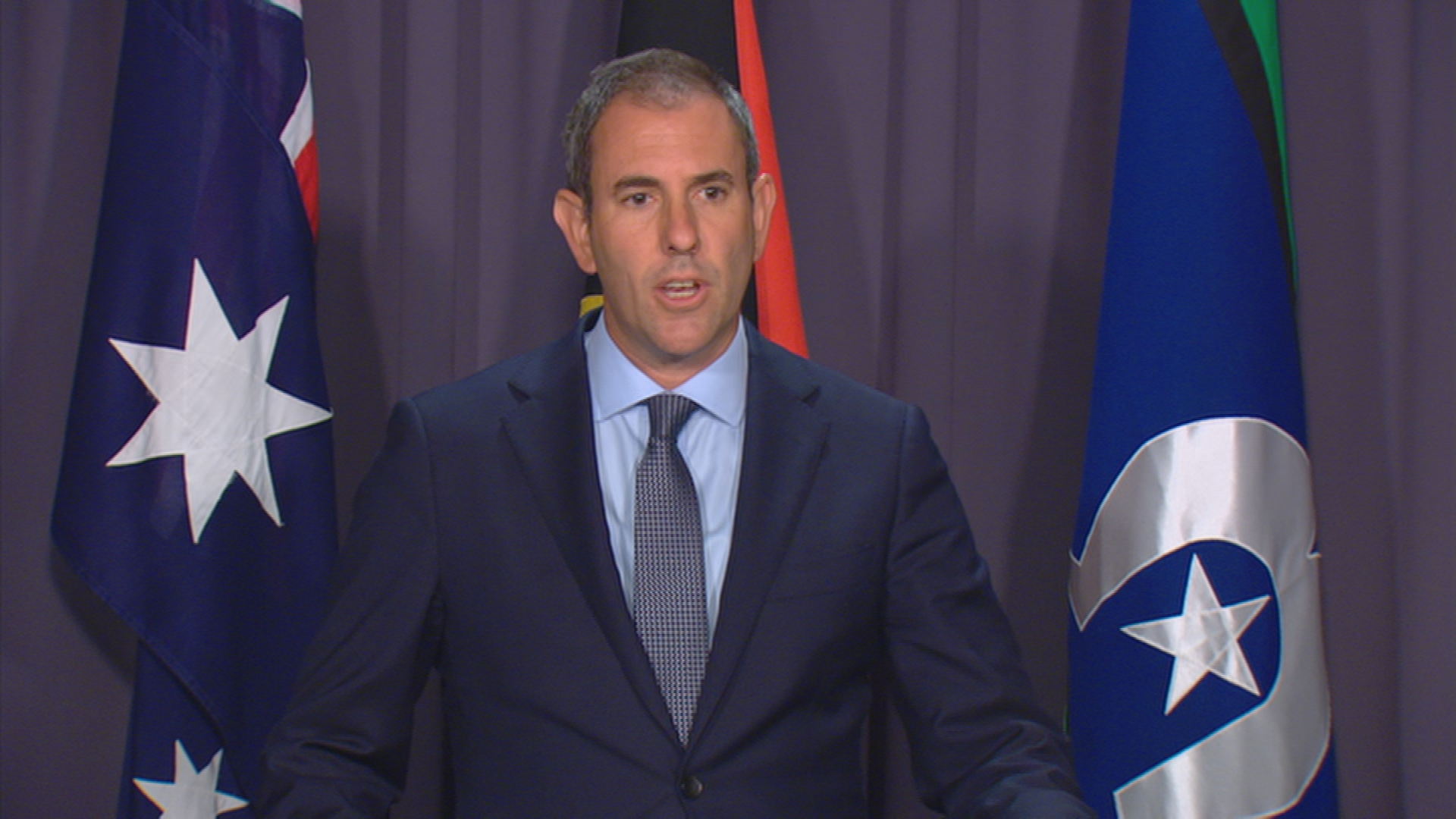

But treasurer Jim Chalmers said Australia's economy is looking positive and despite a global downturn, it will be unlikely Australia enters a recession this year.

"The report (the AAA credit rating) highlights the economy's strong fundamentals, including our historically low unemployment and the good prices we're getting for what we sell to the world," Chalmers said.

"This – along with the beginnings of wages growth after a decade of stagnant wages – are reasons to be optimistic about our economy's future despite the challenging global environment."

If you read between the lines here of the definition of a recession, Chalmer claims GDP is moving up and unemployment remains low - meaning it is likely Australia will dodge the worst of it if global economies begin to decline.

What would a recession mean for the everyday Aussie?

Short answer - it would be bad.

Humphries-Jenner warned if we enter a recession as a result of RBA keeping interest rates too high for too long we will see a rise in mortgage delinquencies and defaults.

"It will be incredibly painful and damaging," he said.

"More mortgage defaults means some people might be forced to do quasi-forced sales of houses.

"Those will be relatively less than what people think because banks want to avoid that."

Basically there will be widespread financial stress, Humphries-Jenner said.

"If rates remain high, that will impact renters and housing affordability because rent will go up as people can't afford to buy a house," he said.

It will create even further demand on rental affordability, even as Australia already experiences a supply and demand crisis, causing immense housing and accommodation pressures.

The next impact would be employment, as corporations reign in expenditure and inevitably slash jobs.

Should we be preparing? If so, how?

Humphries-Jenner said Aussies should always prepare for a downturn and put some buffers in place in case of the worst-case scenario.

"If you have a lot of credit card debt and you think you might struggle with worsening job prospects, then you could go to a personal loan provider and consolidate your credit card debt into a low interest personal loan," he said.

But when considering all of these precautions, he said there are a lot of unknown factors in the coming months that may or may not lead to a recession and no rash financial decisions should be made.

Sign up here to receive our daily newsletters and breaking news alerts, sent straight to your inbox.

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.