Amid a steep rise in impersonation scams, the National Australia Bank (NAB) has unveiled new plans to increase customer protection and stop would-be con artists in their tracks.

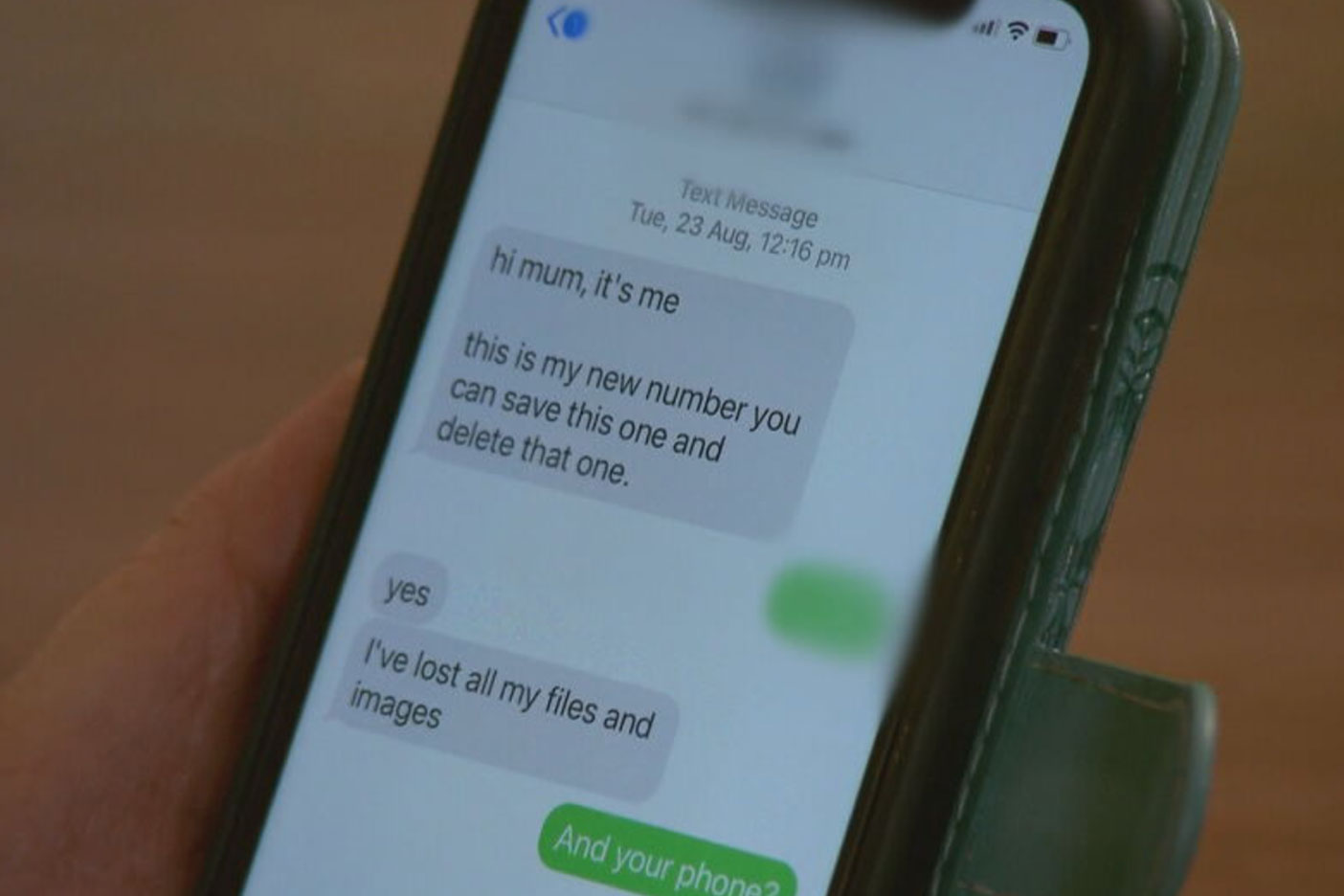

Scams have run rampant on Aussie devices in the last year, with hackers attempting to impersonate everyone from peoples' children, to Australia Post, courier services and pretty much every major bank in the country.

Now, the banking giant says its new plan - which involves placing bank phone numbers on a "do not originate" list to help reduce calls impersonating NAB numbers - will leave customers more safely protected while "reducing scams' impact".

READ MORE: Virus with no cure kills nine people suddenly

"Scams impersonating NAB and other recognised brands have continued to rise, and it's clear we need more collaboration across business sectors to stop this occurring," NAB executive for group investigations and fraud Chris Sheehan said.

"This is not just a problem for banks and telcos, this is an issue for every public and private organisation, and we urgently need a more coordinated national response to the issue.

"By working together ... across business sectors, levels of government and the community we can reduce the impact these scams are having."

READ MORE: Severe weather system to hit almost every state

Sheehan said NAB had also "added additional protections" to reduce scam messages appearing in legitimate bank text message threads.

"There is no silver bullet to stopping scams," Sheehan warned.

"Scammers target individuals and essentially con us into handing over the keys to our accounts and money.

"This means the individual customer is the first line of defence, and that's why it's critical we are all equipped with the knowledge and tools to see through scams and stop these criminals."

READ MORE: Chinese 'spy' balloon sensors recovered from ocean

Aussies are urged to use common sense if they think they might be in contact with a scammer and never reveal private details to anyone they cannot personally verify.

The NAB will never ask people to "transfer their money to another account to keep it safe", Sheehan added.

Sign up here to receive our daily newsletters and breaking news alerts, sent straight to your inbox.