In the lead-up to the federal budget on May 14, 9news.com.au and Joel Gibson are helping bust the budgets of Aussie families.

Aussie parents with small children are facing some of the biggest pain points when it comes to rising weekly costs.

The state of the paid parental leave scheme, RBA interest rate increases and the often exorbitant cost of groceries have meant mums and dads are doing it extraordinarily tough.

READ MORE: Brisbane single mum's $200 bill shock in cost-of-living crisis

Paige and Daman Sandhu, who live in Marsden Park in Sydney's north-west with their one-year-old daughter Aria, are able to slash their weekly spend thanks to their low supermarket spending.

But their mortgage is the biggest drain on their finances.

Paige, 26, tells 9news.com.au her mortgage repayments have been a huge albatross on her family's back – on top of paying for nappies, formula, groceries and bills.

Contact reporter April Glover at april.glover@nine.com.au

Most of their money goes into their variable home loan, which costs the couple more than $1100 every week with an interest rate of 5.99 per cent.

Luckily, they save on takeaway meals and groceries thanks to both working at a restaurant, which often provides lunch and dinner.

Paige says things would feel more manageable if they were able to stash away $250 to $300 more per week.

And when it comes to the federal budget, Paige says she'd love to see the paid parental leave scheme improved.

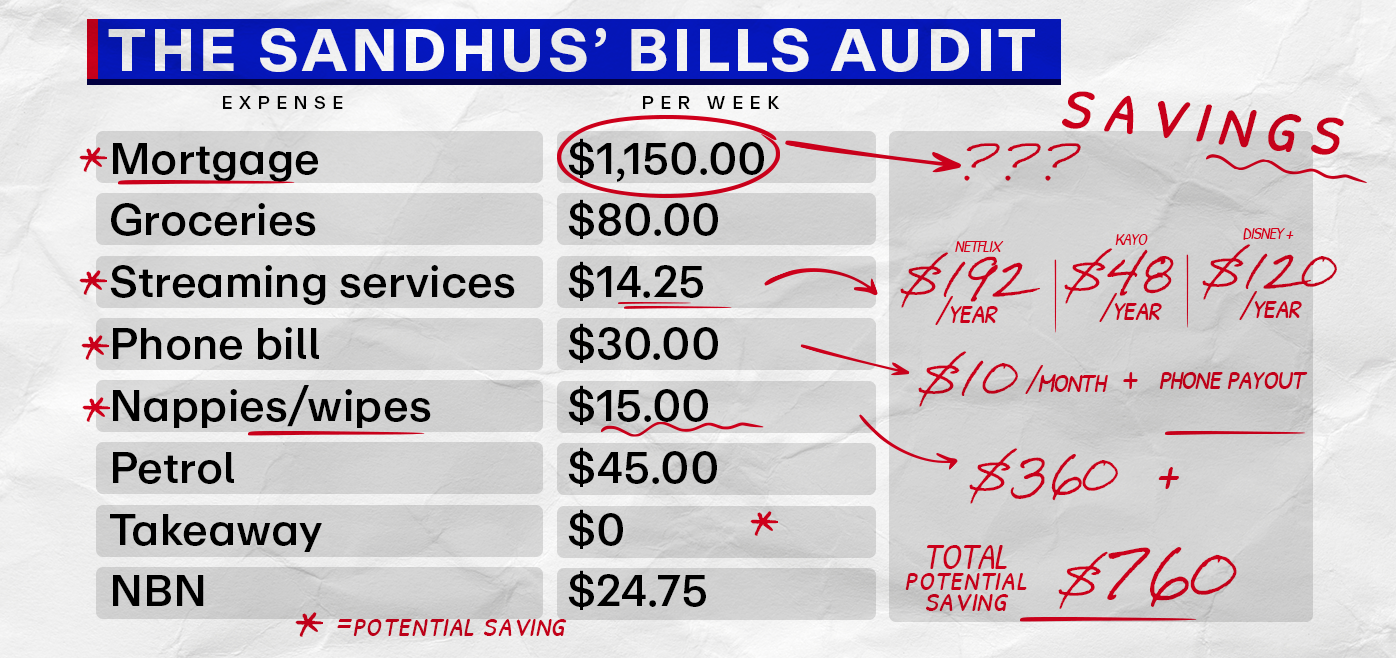

Here's a snapshot of Paige and Daman's weekly bills:

- Mortgage: $1150 per week

- Groceries: $80 per week

- Streaming services (Netflix, Kayo, Disney+: $14.25 per week

- Phone bill: $120 per month, $30 per week

- Nappies/baby wipes in bulk: $15 per week ($60 per month)

- Petrol: $45 per week

- Eating takeaway: $0

- NBN: $24.75 per week

All up, the Sandu family's weekly bills amount to $1359 per week.

On a monthly basis, the family is able to save a lot of money on their energy bills thanks to having solar panels.

Their latest bill for the quarter was just $20.

9news.com.au had personal finance expert Joel Gibson take a look at Paige and Daman's weekly bills and provided some helpful tips for slashing some of their costs.

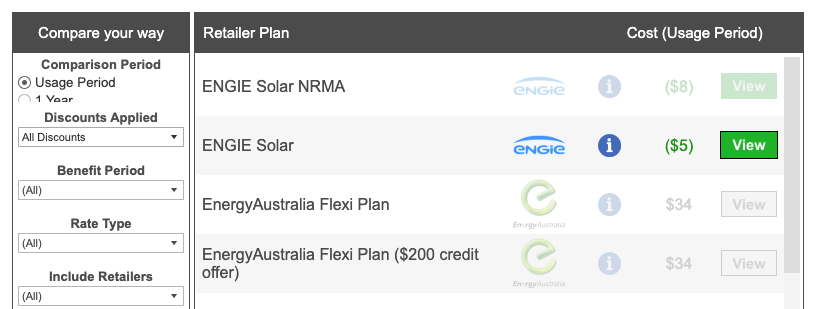

Energy: Save even more!

"It's fantastic to see such a small energy bill thanks to solar. But it could be even smaller," Gibson said.

"Because they export almost three times as much power as they use, it pays to get a really good solar feed-in tariff.

"Currently they're getting a generous 10c per kilowatt hour. But Origin has a Solar Boost plan available to some customers - if they used Origin to install their solar - with an even bigger feed-in."

Gibson noted he checked the solar comparison site Wattever, which found Engie has a solar plan with a 12c feed-in tariff, which would mean the Sandhus would have no bill at all.

"In fact, they might have been slightly in credit for the month," he added.

Streaming: Save over $200 per year

"This bill keeps going up and up. I call it 'streamflation'. Kayo and Disney+ have both raised prices recently, for example," Gibson said.

"One way to save is to turn the services on and off – binge a series, then cancel for a couple of months, then come back to binge another series.

"If you're signed up to Kayo for the footy season, cancel it in the summer. Same for other seasonal sports."

Another way to save, Gibson explained, is to downgrade. Netflix has a Basic tier with ads that costs $192 less than Premium per year.

Kayo also has a one-screen option (no ads) that costs $120 less per year.

Disney+ has a standard plan (no ads) that costs $48 less per year.

Netflix has cracked down on password sharing and Disney plans to do so, but you can still get away with it for the time being.

"And don't forget all the fantastic free content available on 9Now (part of Nine, the publisher of this website), 7Plus, ABC iView, SBS On Demand and 10Play," he said.

Mobile: Save more than $200 per year

For $120 per month, Vodafone is giving Paige 80GB of data and a phone repayment.

But Gibson has found an even better deal.

"According to leading comparison site Whistleout, you can get the same amount of data on the Vodafone network with Kogan for $40 per month or unlimited data with Felix (owned by Vodafone) for $40 per month. So you could save about $10 a month by switching but, of course, you'd have to pay out your phone," he said.

"It's worth checking how many device repayments you have left – if it's not too much to pay it out and you can afford it, you could end up ahead."

He also says watching how much data you use in a month and adjusting your plan could save you a lot in the long run, too.

"I'd also check if you're using 80GB a month. The average person uses around 15GB, so you might be able to save hundreds of dollars by downgrading to a smaller plan at around $30 per month. Vodafone also has an annual plan with 320GB for under $30 per month," he said.

Baby supplies: Save more than $360 - potentially

"They're lucky to have such a low grocery bill. This one is a real stress for a lot of families," Gibson said.

"Baby supplies aren't cheap but luckily they're able to be bought in bulk and stockpiled if you find a cheap price."

He added: "Paige and Daman are also lucky enough to live near one of the 15 Costco warehouses in Australia. Costco membership is about $70 a year but see if a friend has a card and borrow theirs!

"It sells 184 size 3 Huggies nappies for $63, which is 35c each. At Woolies, the biggest box is 90 nappies at 43c each. So if they're not already shopping at Costco, they could cut their nappy costs by around 19 per cent or $144 a year."

He also suggests shopping around different brands for nappies.

"Changing nappy brands can save even more – Aldi's Mamia nappies cost just 21c each, which would be a 50 per cent saving compared to buying Huggies at the major supermarkets," Gibson said.

"Amazon also has occasional specials on nappies and wipes that are cheaper still so keep an eye out and stock up, especially around Prime Day in July."

Mortgage: Worth a try

"5.99 per cent is a pretty good rate so I can't promise there are any significant savings here," Gibson said.

"But it never hurts to shop around as a small difference in mortgage rate can add up to thousands of dollars over time."

Gibson recommended checking out the lower rates on Ratecity, which listed mortgages with CBA or Reduce Homeloans for around 5.90 per cent.

"Or you could try a platform such as Joust which collects your info and introduces you to the bank or broker that can offer you the best rate," he said.

"This saves you the hassle of shopping around yourself."

Joel Gibson is the author of EASY MONEY, and a money-saving expert on TikTok, TODAY, 2GB, and ABC Radio.

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.