A sign displayed inside a pub in Sydney's Inner West is making a quiet stand against multinational beer giants to give independent breweries "a fair go".

Australia's craft beer scene has soared in popularity in recent years but a concentrated beer market has many smaller independent breweries struggling to stay afloat.

High taxes on beer manufacturing combined with industry challenges posed by the COVID-19 pandemic has led to a string of independent producers to shut up shop across the country.

READ MORE: What Australia's weather is going to do in winter

Making matters worse for independents are the duopolies that dominate the industry.

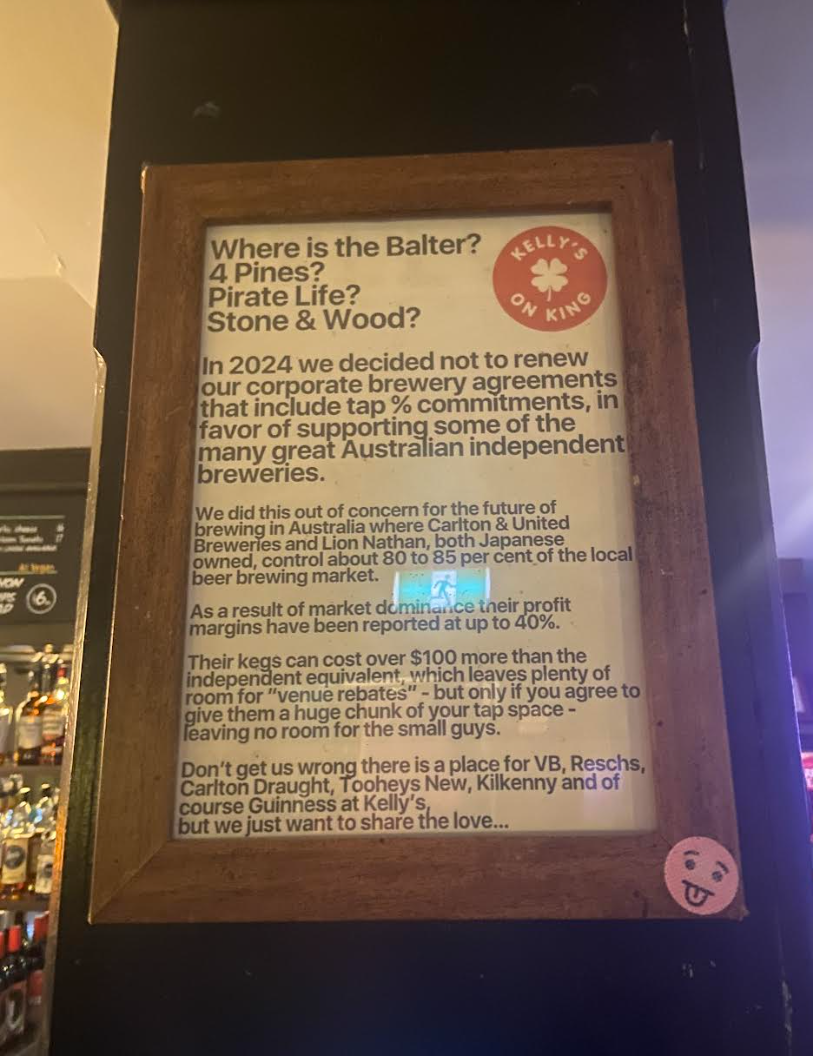

In response to the "unfair and unequal" situation of the beer market, Newtown pub Kelly's On King has decided to end its corporate brewery agreement with Carlton & United Breweries (CUB).

Multinationals CUB (owned by Japan's Asahi) and Lion (part of fellow Japanese giant Kirin) dominate about 80 per cent of the market share.

Licensee Brodie Parish told 9news.com.au an anti-competitive price model was pushing independents out of the market and inflating beer prices for consumers.

https://www.instagram.com/p/C5h1YV7SZU3/?igsh=bDduOXZzNmRoeXBo"We want to make sure consumers understand why we had to take the action we have," Parish said.

"But part of me also wants to force some kind of change.

"We want consumers to start to understand the mechanics behind having two big breweries and the fact it's not healthy for the beer market."

He explained the pub had a contract with CUB up until November last year which gave them a $75 discount per keg in exchange for 60 per cent of tap space.

"That's the only way you can get a reasonable price on those kegs, VB, Carlton Draught, or a Resch's keg, which is perceived by the market as being the cheaper beer or schooner price," he said.

"Each keg is priced about $330 and $340 per keg so with that discount, it brings it down to that high $200 mark."

READ MORE: Crafty tactic big bottle-os are using to trick you into buying their own beer

But, he said, the deal had locked out independent producers, which typically sell kegs between $240 and $270.

"We did go to CUB and say we're happy to give you 30 per cent of our taps if you can make your keg prices competitive with other producers in the market," Parish said.

"But they basically just gave us a 'no' and said we need at least 50 per cent to talk.

"So that's why we took the measures we did."

Parish, who has worked in pubs for 25 years, said in the last five years he's seen "more aggressiveness" from bigger breweries trying to claw back some of the market they've lost to independents.

"Everyone has the exact same concerns, they have the same views, but I think different business models might mean to speak out about it would be detrimental to their relationships," he said.

"Whereas we're an independent-focused venue - the drawbacks, making a stand against it, or not signing agreements, aren't as detrimental to our future."

The ACCC probed beer tap contracts in 2017 following claims from craft breweries they'd been locked out of pubs but did not go as far as making enforcement action.

Parish believes the competition watchdog should have gone further with the investigation.

"I think some of the agreements should be reviewed by the ACCC, I think they should go wider with their inquiry, it warrants a review and further investigation," he said.

In response to Kelly's on King's decision, a CUB spokesperson told 9news.com.au: "We respect Kelly's as a great venue, with great people.

"Like any pub, they are best placed to decide what tap beer is best for their drinkers.

"We're pleased that Kelly's continues to range some of our great beers such as VB and Resch's and we welcome the competition from other breweries offering other beers."